Methodologies

Introduction

MainStreet Partners has been 100% focused on sustainable investments since it was founded in 2008. MainStreet Partners believes that Environmental, Social and Governance (ESG) factors have a material effect on the long-term performance of investments. Accordingly, all our advice under our Sustainability Advisory business take sustainability risks into account (Article 4; SFDR). Additionally, we are disclosing an overview of our sustainability methodologies used in our Portfolio Analytics business to provide transparency on the manner in which sustainability risks are considered (Article 6; SFDR).

MainStreet Partners supports its clients to integrate sustainability risks into the investment process (both at the firm level and financial product level) and to implement different responsible investment strategies into financial products which consider adverse sustainability impacts, such strategies including norms-based screening or restrictions, ESG integration, sustainability-themed investing and impact investing. Our approach to these different strategies is rooted in our sustainability philosophy as a signatory to the UN PRI and endorsement of internationally recognized standards such as the United Nations Global Compact.

The sustainability methodologies used by MainStreet Partners to consider the principal adverse impacts of sustainability risks cover the following asset classes:

Corporates

![]()

Sovereigns

![]()

GSS Bonds

![]()

Funds

![]()

SDG Alignment

![]()

MainStreet Partners’ methodologies share a common background and philosophy while being applied in a coherent manner to a broad range of asset classes and instruments. Additional information is available upon request.

The final MainStreet ESG Score ranges from 1 to 5, with 1 representing a weak ESG profile and 5 representing a strong ESG profile. MainStreet ESG Scores are reviewed on a monthly basis for corporates and quarterly for funds. We conduct monthly monitoring for corporate issuers and quarterly for funds.

Corporate Issuers ESG Analysis

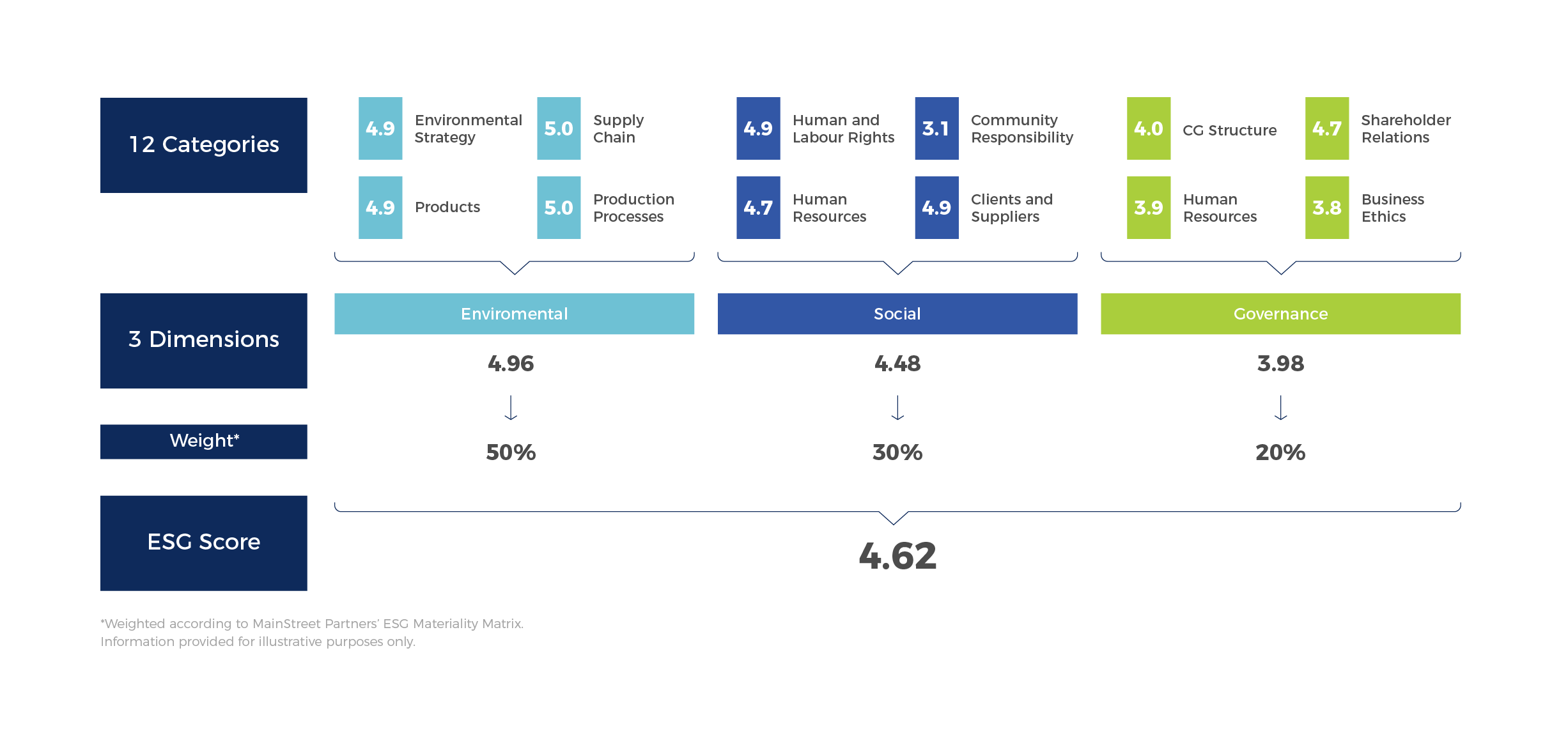

The MainStreet ESG Score of corporate issuers is determined by its performance on material ESG indicators which MainStreet groups into 4 key parameters under each pillar of ESG, for a total of 12 key categories. MainStreet has chosen these 12 key categories based on its expertise in ESG assessment and based on guidance from leading authorities such as the Sustainability Accounting Standards Board. Below, we have outlined the key categories which we use to build our ESG assessment of corporate issuers .

Each of the 12 categories is assessed in a quantitative way by analysing and aggregating material ESG indicators. This data is cleaned and normalised to address common issues associated with ESG data such as reliability, subjectivity or lack of sufficient coverage. There are four different types of ESG indicators: (i) company policies, (ii) company targets, (iii) quantitative KPIs, and (iv) controversies.

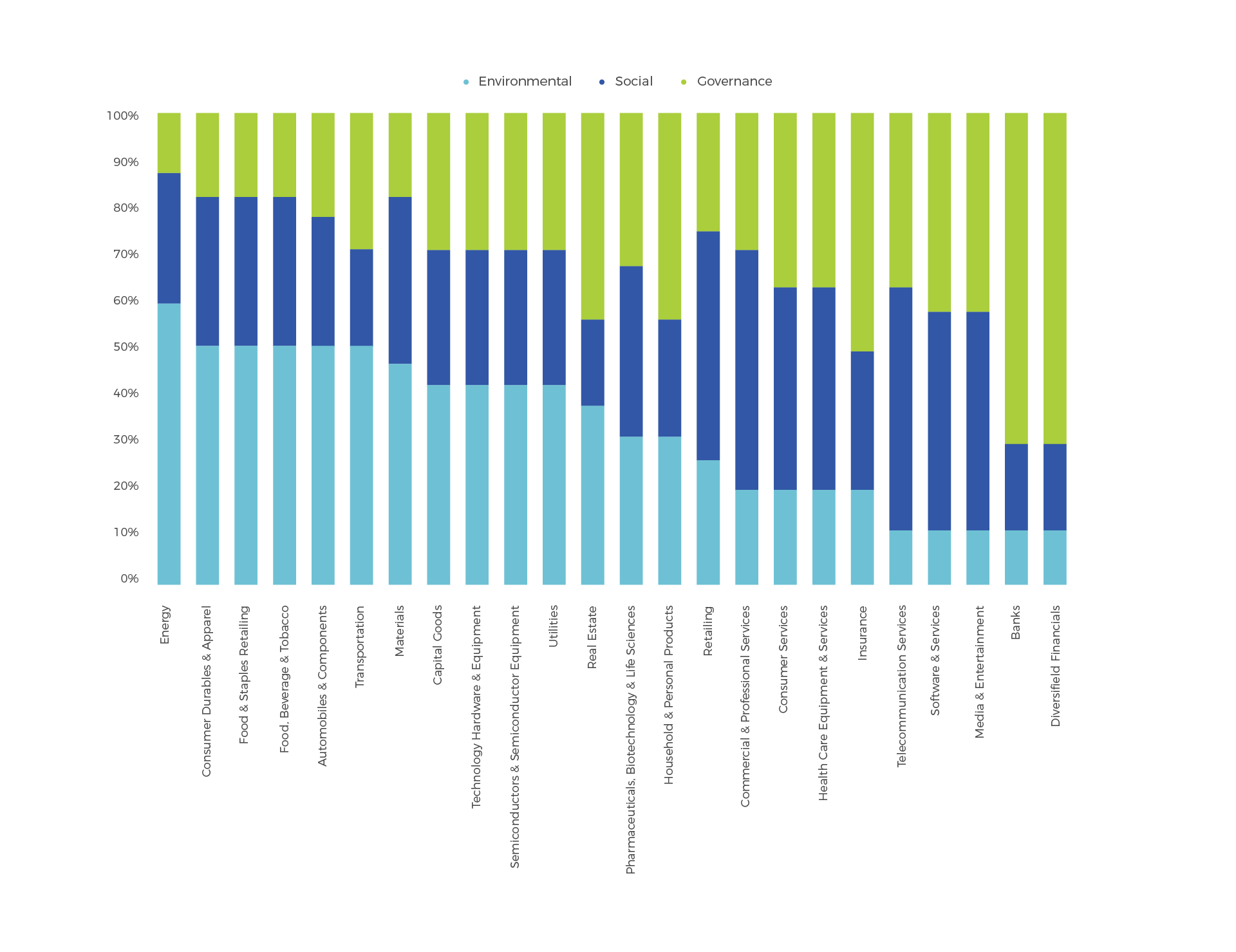

Once each of the 12 categories has been scored on the basis of the underlying indicators, a weighted average of these results produces a score for each pillar of ESG. However, companies in different sectors are not equally sensitive to environmental, social or governance issues. Therefore MainStreet assigns varying weights to each pillar of ESG depending on each one of the 24 GICS industry groups’ sensitivity to ESG issues represented by the materiality matrix below:

This materiality matrix provides the weights to calculate final overall MainStreet ESG Scores which more accurately reflect a company’s ESG performance vis-à-vis the issues which are most material to it. Please find below an example of the ESG Company model process.

.

Controversial Behaviour

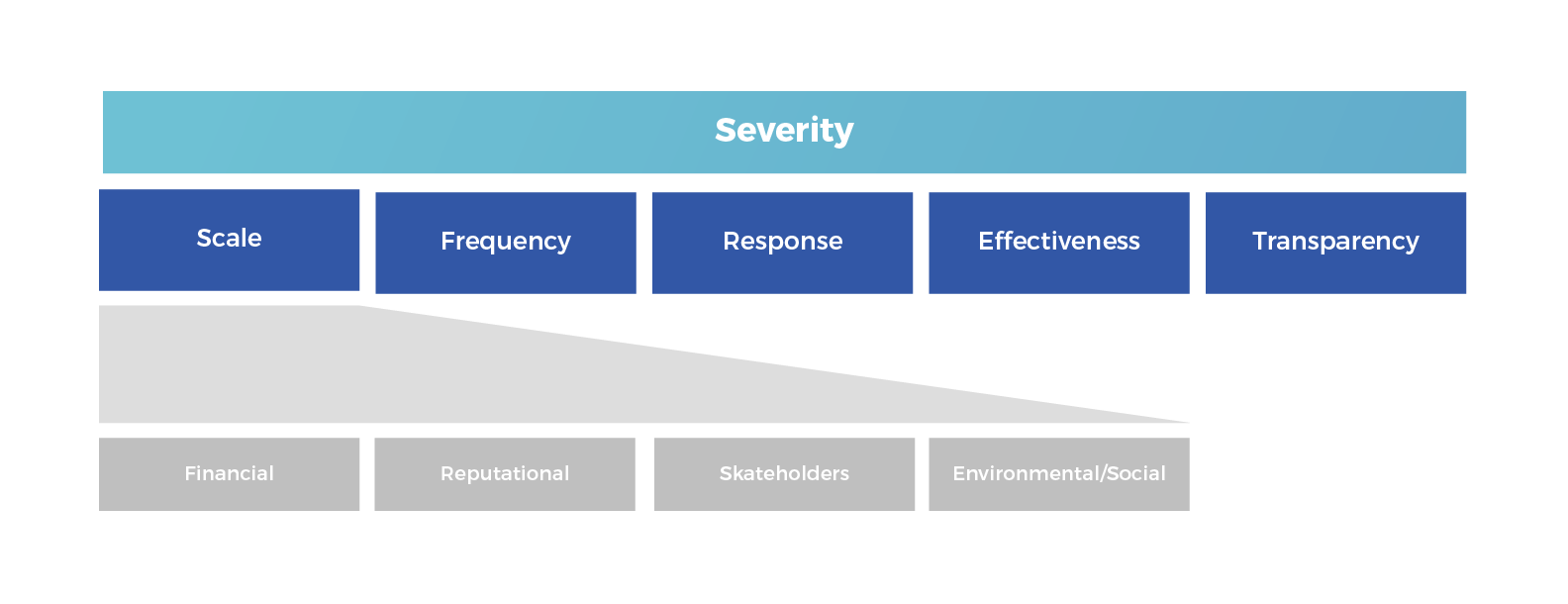

In order to assess the impact that controversies may have on the issuer ESG performance, MainStreet has developed a robust assessment framework that aims at determining the severity of the event. The analysis is based on five parameters: Scale, Frequency, Response, Effectiveness and Transparency.

This analysis allows us to identify the severity of an ESG controversy.

- A Red Flag will be assigned to a company engaged in any controversy which is deemed sufficiently material to warrant exclusion from investment, where material means that it represents a significant threat to the company’s business and future performance;

- A Yellow Flag will be assigned to a company engaged in any controversy which has relatively lower potential negative impact on the company’s business, but which is deemed sufficiently material to be brought to the portfolio manager’s attention since it might develop into a material ESG risk.

Government Issuers

Our Country ESG Model aims to evaluate a country’s exposure to and performance in respect of material ESG issues. The philosophy of the model is that a country which properly manages these ESG issues should enjoy long-term prosperity and sustainable economic development. The model is based on the premises that a sustainable country is one which:

-Reduces its impact on nature, favouring cleaner sources of energy and preserving natural assets such as forests and groundwater

-Provides adequate essential services such as education or internet access, ensures a sustainable pace of population growth and reduces inequalities

-Adopts a robust political system subject to the rule of law and fosters a business-friendly environment, and

-Enables long term prosperity of its citizens and reduces geopolitical risk through a strong macroeconomic performance and energy security

The four premises above form the four pillars of the Country ESG Model. Under each pillar there are categories which group similar ESG indicators together. For example, under the Environmental pillar there is an Emissions category which includes indicators related to CO2 intensity and greenhouse gas emissions.

Starting from approximately 400 indicators, 88 have been selected due to their robustness, availability and relevance of data and ESG issues. Examples of statistics databases from which the indicators are sourced include: World Bank Development Indicators, Ease of Doing Business Report, UN Development Index, World Health Organisation, Standardized World Income Inequality Database, Social Progress Index, Freedom in the World Report, CIA World Factbook.

Each of the indicators has a weight contributing to a category and finally to its respective pillar. Each pillar contributes to the overall Country ESG Score which is calculated as the weighted average of the pillar scores. The Environmental, Social Conditions, and Governance and Politics pillars are assigned a weight of 30% each because they are core ESG issues and then the Macroeconomics pillar has a weight of 10%.

Green, Social and Sustainability Bonds

MainStreet has a special methodology for Green, Social and Sustainability Bonds (“GSS Bonds”) which distinguishes their rating from general corporate purpose bonds. Since GSS Bonds have specified use of proceeds, the rating methodology must take into account not just the sustainability profile of the issuer but also the profile of the issuance itself.

Issuer-specific evaluation (50% of the overall weight)

(i) ESG scores of corporate issuers are determined according to an in-house proprietary Company ESG Model.

(ii) ESG scores of supranationals, agencies and sovereigns are determined according to an in-house proprietary Country ESG Model.

Issue-specific evaluation (50% of the overall weight)

(i) Sustainability of the Framework (25% of the overall weight): this analysis evaluates the level of governance in place for the specific bond.

(ii) Use of Proceeds Additionality (25% of the overall weight): this analysis evaluates the quality of the eligible projects and the financing mechanism.

Funds ESG Rating

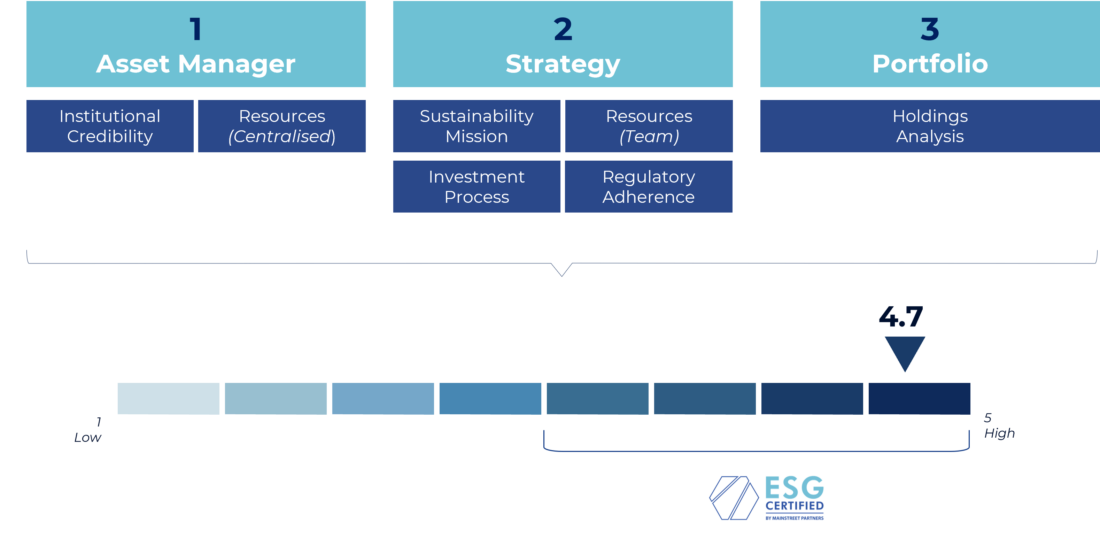

MainStreet implements a structured process using a robust proprietary methodology to evaluate a fund’s sustainability level. Our methodology is unique because involves a 3-pillar holistic assessment which considers 1) the overall asset management firm, 2) the fund’s strategy and 3) the single holdings in the fund. This enhanced methodology distinguishes MainStreet from the major ESG providers which tend to focus only on the holdings or the strategy label. The sustainability rating ranges from 1 to 5 with 5 being the highest score. Above all, our approach is designed to eliminate the risk of greenwashing in investment products which can cause significant reputational damage.

MainStreet has developed a score card which assists its sustainability evaluation of third-party funds. MSP has identified 100+ material indicators which provide a comprehensive assessment of a fund’s ESG performance. Most importantly, each indicator has five pre-determined answers, one of which must be selected by the analyst conducting the due diligence. This restriction ensures that different funds are scored consistently by different analysts leaving little room for subjective judgment. A qualitative review is then held at the team level and every ESG fund score-card is subject to the “4-eyes principle” in addition to annual analyst coverage rotation to maintain the maximum possible level of objectivity.

SDG Alignment

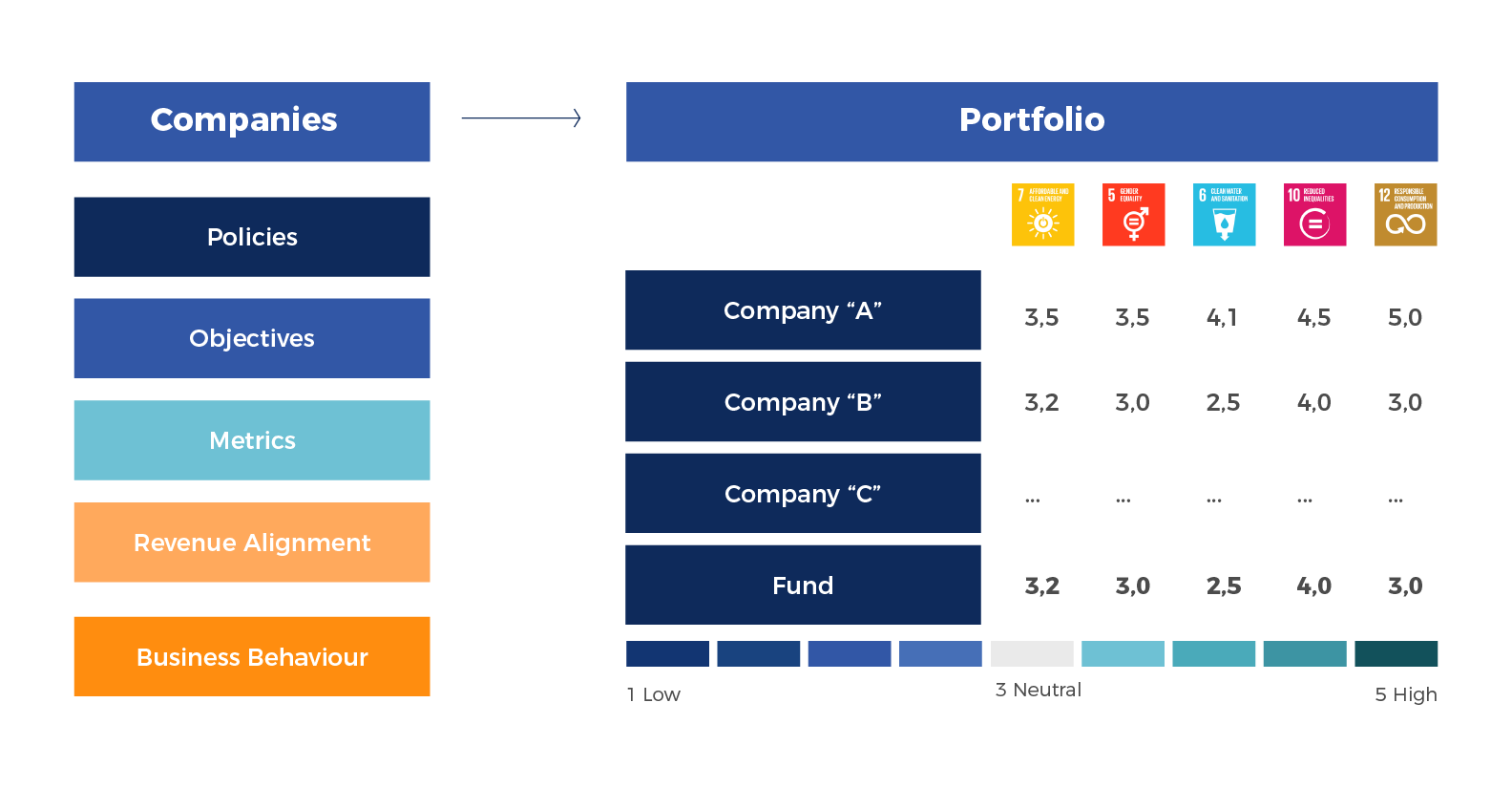

MainStreet Partners has developed an analytical model to assess a company’s alignment to the SDGs. Alignment of a company to the SDGs can be considered through three different lenses: (a) the company’s management decisions and operational activities, (b) the company’s products and/or services, and (c) the company’s behaviour and involvement in controversies. For each SDG, the Model calculates an SDG Score. SDG Scores range from 1 to 5 and a score of 3 represents neutral alignment.

By aggregating company-level data, the Model is additionally able to assess a fund’s alignment to the SDGs.