ESG Advisory

Help investors to build sustainable products

With a proven investment process that dynamically combines ESG, Impact, and financial criteria, MainStreet Partners provides bespoke portfolios of funds, equities and thematic bonds as part of a multi-asset balanced or stand alone strategy.

Applying the highest standards of financial and extra-financial due diligence, our objective is to achieve superior market risk-adjusted returns while delivering tangible positive social and environmental results.

MainStreet Partners has been developing its capabilities and track record of investing in sustainable companies and funds since 2008 and is the sub-advisor of several funds and discretionary portfolios.

Financial Analysis

and Portfolio Construction

![]()

Selection of Our

Impact Investments

![]()

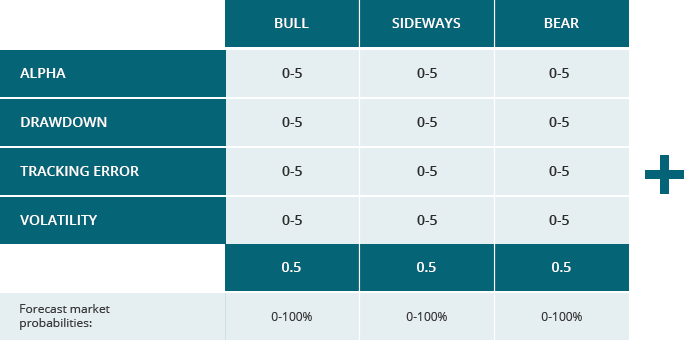

Funds Financial Analysis

Funds undergo a quantitative evaluation within their respective clusters in order to identify over-performance, sources of alpha and risk factors. Our forward looking process assesses fund performance against different market environments. In-depth qualitative analysis is undertaken to support our in-house opinions regarding a fund’s value-add and persistence of returns.

Qualitative Analysis

- Asset manager’s institutional credibility

- Experience of the portfolio management team

- Investment process and competitive advantage

- Value of active management

- Management style

- Principal risk factors

- Fees and administration

Funds Portfolio Construction

While building multi-asset portfolios, MainStreet Partners adopts a Core-Satellite approach in order to build stable and well-balanced portfolios able to invest in the most relevant sustainability themes.

Core

Stable Growth and Risk Management

Equity, Fixed Income and Multi-Asset funds with solid ESG and financial features

Satellite

Tactical / Thematic Opportunities

Thematic funds and specific holdings in sectors with high growth potential such as renewable energies or health

Thematic funds have relevant sectorial and market cap biases

Issuer Financial Analysis

We apply a quantitative model based on company specific financial fundamentals in order to identify companies that show a consistent and superior combination of solid cash flows, margins, return on invested capital, growth factors and valuation parameters vs. peers.

Quantitative Analysis

Fundamental Financial score

Valuation score

Sector adjustment

Qualitative Overlay

Focus on Risk Indicators

Segment potential and Market share

Intangible assets and earnings visibility

Competitive advantage and Regulations

Direct Portfolios Construction

We adopt two portfolios construction models when investing in direct equities and bonds depending on the strategy:

- High conviction (e.g. impact balanced portfolios)

- TE minimisation (e.g. sustainable large cap portfolios)

High Conviction

High Sustainability

- Concentrated portfolios of High Conviction stocks and bonds (about 40/50 holdings)

- Multi-thematic allocation that allows to invest in trends as environmental, sustainable and healthy food, advanced treatments, digital infrastructure, education and the like

- Flexible allocation that leverages on low-correlated stocks that generate stable cash flows from renewable energy assets and sustainable infrastructures

TE Minimisation

ESG Maximisation

- Minimise the tracking error in respect to the reference index

- Ex-Ante maximisation of the ESG profile, SDGs contribution and social/environmental indicators

- Take into account the main risk factors in single stocks, sector, or geographic exposure in order to adhere to portfolio’s constraints imposed by the client

- High quality investable universe selected using our quantitative financial model

Selection of Our Impact Investments

CLIMATE CHANGE

Equity – Brookfield Renewable Partners

According to IEA’s Renewables 2019 report, renewable energy will grow by a staggering 50% in the five years between 2019 and 2024. Brookfield Renewable Partners operates one of the world’s largest publicly traded renewable power platforms. It is one of the largest owners, operators and investors in renewables globally with over €45 billion in total power assets, 19,000 MW of hydro, wind, storage, solar and distributed generation assets managed by approximately 3,000 employees in 17 countries.

In 2019 Brookfield generated enough renewable energy to power 7,250,000 European households for a year

FOOD

Equity – Hain Celestial Group

Consumers are increasingly focusing on health issues and they are driving demand for local, natural and organic food – this is a demographic trend with nearly 9 out of 10 millennials identifying healthy eating as key to personal wellbeing. The Hain Celestial Group, founded in 1993, is a leading organic and natural products company. Since inception it has been dedicated to making healthier food and personal care products and to reducing its impact on resource scarcity and climate change, especially by minimising food waste. Hain Celestial’s tea bags are designed without a string, tag, staple and individual wrapper which eliminates approximately 1.5 million kilograms of unnecessary waste each year.

40% of Hain Celestial’s products are certified organic

FINANCIAL SERVICES

Social Bond – Caixa Bank

Caixa Bank is a Spanish financial services company which issued a €1 billion Social Bond in September 2019 to finance SMEs in economically disadvantaged regions of Spain in order to promote employment creation, as well as to extend loans to low income individuals or families. Since Caixa Bank set up its microlending business in 2007, it has granted more than 930,000 microloans, helping families to cover expenses, purchase electrical appliances or acquire vehicles. Caixa Bank’s SME lending business supports a variety of sectors but primarily agriculture and tourism which is dominated by microenterprises which are often excluded from the traditional financial sector.

Since 2016, Caixa Bank has supported over 250,000 low-income families

HEALTHCARE

Social Bond – Caisse Française de Financement Local (“CAFFIL”)

French public hospitals provide health services for the whole population regardless of income. CAFFIL is the financing subsidiary of SFIL Group which is a local government and public hospital funding agency. As at June 2019, CAFFIL had extended loans amounting to €2.6 billion to the French public healthcare system. Its €1 billion Social Bond issued in February 2019 covered loans from all regions in France and supported 97 hospitals, 65,675 hospital beds and 3,464,528 hospital visits.

CAFFIL’s Social Bond provided financial support to 97 hospitals

EDUCATION

Equity – FDM Group

Higher education qualifications are becoming critical for many careers as the job market becomes more specialised and technologically advanced. HR departments are finding it increasingly difficult to hire the right talent and often fall back on heuristics by only hiring those from top universities or individuals based on informal networks, which typically favours those from more affluent backgrounds. One of the leading companies overcoming this structural challenge in the graduate labour market is FDM Group which is an international professional services company that recruits high-achieving graduates and contracts them to blue chip companies as consultants with a view to them being hired after the contracted period. FDM currently has over 4,000 graduates at 400+ companies worldwide.

Last year FDM helped over 4,000 graduates secure employment in IT

“Information provided for illustrative purposes only and not to promote companies or investments presented. Past performance does not guarantee future results.”